Automobile insurance plan can consist of various sorts of insurance coverage that offer varying functions, and you can select to be covered by some or every one of them. Several of these insurance coverage options require deductibles and also some do not, so it deserves noting what deductibles you'll be called for to pay. State law generally identifies whether or not a deductible is needed.

This covers you if your automobile hits one more automobile or object and you need to spend for repairs. Accident deductibles are common but differ by insurance firm. If your car is harmed by an occasion such as fire, a falling object striking your windscreen or vandalism, you'll file a comprehensive coverage insurance coverage case.

If the various other chauffeur in a crash is at mistake but they aren't guaranteed or don't have sufficient insurance coverage to spend for your home damages, this type of coverage will certainly come to the rescue. Deductibles are sometimes needed for this insurance coverage, however not always, and also requirements vary by state. While your cars and truck insurance policy deductible can differ substantially depending upon numerous aspects, consisting of exactly how much you want to pay, automobile insurance coverage deductibles generally range from $100 to $2,500.

When selecting an insurance deductible, you'll require to think about several variables, including your budget plan. Invest time determining exactly how much you can manage to spend for an insurance deductible as well as just how much you'll conserve on your regular monthly premiums by going with a higher one. Ask on your own these inquiries when selecting an insurance deductible quantity.

trucks cheaper cars cheap affordable

trucks cheaper cars cheap affordable

You need this buffer in situation the most awful happens, yet if you're a risk-free motorist or don't drive frequently, making use of a reserve to cover any type of crashes may be a choice. This is an important question when considering what insurance deductible to choose. If you enter a crash, can you pay for the insurance deductible or would certainly you battle to pay it? Taking on a high insurance deductible might not make much sense if it stands for a huge section of the car's worth (auto).

Some Known Details About What Is A Deductible In Car Insurance? - J.d. Power

Keep in mind, your automobile's actual cash money worth takes into consideration the price of your automobile when you acquired it, as well as the age as well as condition it's in at the time of the mishap. Exactly how do I pick a deductible? It is necessary to choose a deductible that you fits your monetary scenario. cheapest auto insurance.

On the various other hand, if you do not have sufficient cash to cover your insurance deductible on the occasion that there's covered damages to your automobile, you might have difficulty obtaining your car repaired. To pick the correct amount, consider just how much you can pay out-of-pocket to have your cars and truck repaired without experiencing a lot of monetary anxiety in your life. auto insurance.

You have an accident case that creates $6,000 in damages to your auto, which has an actual money value of $20,000. 00 deductible.

cheapest auto insurance laws cheapest car auto insurance

cheapest auto insurance laws cheapest car auto insurance

Have inquiries concerning your current deductible or readjusting it? Offer us a call at or drop in a Direct Auto Insurance coverage location near you (auto insurance).

Let's state you just obtained in an accident and also your car needs $4,000 out of commission, yet your insurance coverage will just cover $3,000. If you're confused, comprehending your car insurance coverage deductible may be the solution. In this post, we'll describe what an auto insurance policy deductible really is, when you require to pay it, as well as whether you should pick a high or reduced one.

5 Easy Facts About How To Choose Your Car Insurance Deductible (2022 Guide) Described

You do not really pay a deductible to the insurance coverage firm you pay it to the fixing store when they repair your car. Depending upon your state, you might have an insurance deductible for various other types of protection, too. Allow's claim you sue that causes a $2,000 cost. If you have a $500 deductible, you have to pay that quantity prior to the insurance business pays the continuing to be $1,500.

Your cars and truck insurance coverage deductible does not function like your health and wellness insurance policy deductible. With health insurance coverage, you have a deductible that obtains reset every year.

When the brand-new year rolls around, all of it beginnings over. With automobile insurance policy, you pay your deductible each time you sue. Let's state you got right into an accident as well as filed an accident case. On your way to the service center, a freak hailstorm storm includes even more damages to your automobile - laws.

There is no limit to exactly how numerous times you pay your deductible in a year. How Do Cars And Truck Insurance Deductibles Job?

For instance, if you stay in an area with constant poor climate, you could desire to choose a reduced comprehensive deductible to limit what you pay of pocket - insurance affordable. At the same time, you can keep your crash insurance deductible higher to cancel your vehicle insurance premium. Kinds Of Insurance Policy Protections With Deductibles Right here are the common sorts of car insurance, with details on what they cover and also whether they call for a deductible or not.

What Should My Insurance Deductible Be? for Dummies

In that situation, your auto insurance policy premium would certainly set you back more to counter the $0 vehicle insurance deductible. When Do You Pay A Cars And Truck Insurance Policy Deductible? Right here are the major circumstances in which you 'd be accountable for paying a deductible: If you trigger a car crash and your automobile needs fixings, you'll pay your deductible on your crash protection. cheaper car insurance.

cars vehicle vehicle insurance perks

cars vehicle vehicle insurance perks

Exactly how To Select A Vehicle Insurance Coverage Deductible Now that you know what an automobile insurance coverage deductible is, it is essential to choose the appropriate deductible for your scenario. You must select a high auto insurance deductible if you desire to reduce your month-to-month costs and also if you have the capability to pay it.

If you do not have any type of savings, it's not a smart suggestion to have a high insurance deductible. You could be the very best motorist in the world, however you still share the roadway with bad vehicle drivers and uninsured vehicle drivers. According to the Insurance Coverage Details Institute, concerning 6 percent of motorists that had accident protection filed a claim in 2018.

You can always pick a lower insurance deductible while you conserve up a reserve and after that increase the deductible later on. You should choose a low automobile insurance coverage deductible if you do not have the capacity to pay a high one, or if you intend to secure your out-of-pocket costs. A reduced insurance deductible might be a good concept if you live in an overloaded area where you have a greater opportunity of experiencing an accident.

Some programs will certainly reset your insurance deductible to the complete amount after you make a case, and also others will certainly reset it to a smaller amount. After five years, you would have paid an added $100 or even more to your insurance business.

What Is A Deductible In Car Insurance? - J.d. Power - Questions

What Occurs If You Can Not Pay Your Deductible? When paying out an insurance claim, your insurance provider will certainly frequently write you a check for the quantity it's responsible for covering. If you are not able to pay the remainder of your expenses for the deductible, you might have some alternatives. Below are some steps you can take if you can not manage to pay your insurance deductible: Maybe worthwhile to speak to your technician concerning settlement alternatives after a mishap. cheapest.

cheap auto insurance cheaper auto insurance affordable car insurance business insurance

cheap auto insurance cheaper auto insurance affordable car insurance business insurance

Knowing when to readjust your insurance deductible and when to Helpful site shop around for a brand-new car insurance coverage company with budget-friendly rates is the most safe method to avoid high expenditures in the future (cheapest car). Our Suggestions For Cars And Truck Insurance Searching for cars and truck insurance policy doesn't have to be challenging. Simply see to it to obtain quotes from several carriers, so you can compare rates.

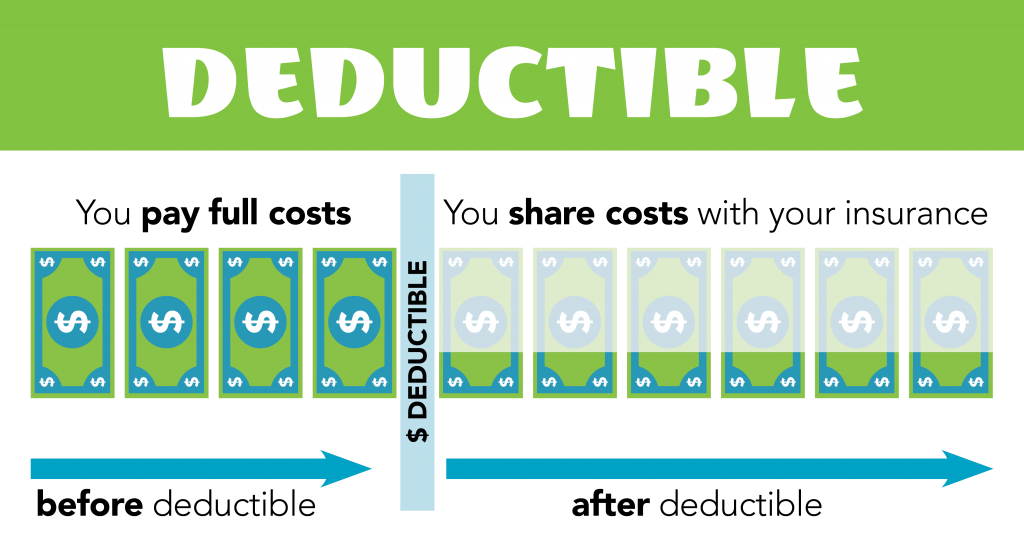

If you have actually already experienced a case, you've likely found out exactly how your deductible jobs initial hand. For those that have not, it can create complication about simply what a deductible is and also that spends for it. prices. What a deductible is An insurance deductible is the amount of cash you (the named insured on the plan) pays out of pocket for the cost of problems before the insurance company pays.

Your insurance company will certainly pay the continuing to be equilibrium of $500 to the garage. Considering that you have actually chosen a $500 deductible, you will certainly be responsible for the expenditures.

While the quantity of your deductible can increase or decrease your costs, insurance deductible as well as premium are 2 various points. The called insured on the policy is accountable for paying the deductible quantity.

Some Known Questions About What Should My Insurance Deductible Be?.

It's not the same as a health insurance coverage deductible. As with all points insurance, it's best to discuss deductibles and also exactly how they use in your scenario with a neighborhood independent insurance policy agent. Your neighborhood independent agent has the understanding and experience to address regularly asked questions concerning deductibles and also determine cost financial savings for you depending on the deducible quantity you pick.

When it pertains to auto insurance policy, an insurance deductible is the quantity you would certainly have to pay of pocket after a protected loss before your insurance coverage starts. Car insurance coverage deductibles function differently than medical insurance policy deductibles with cars and truck insurance, not all sorts of insurance coverage need an insurance deductible. Obligation insurance does not need a deductible, but comprehensive and crash protection usually do.

When you're adding that coverage to your automobile insurance plan, you'll usually have the possibility to determine where you intend to establish the insurance deductible. cars. Usually, the higher you set your insurance deductible, the reduced your monthly insurance premiums will certainly be but you do not want to establish it so high that you wouldn't have the ability to really pay that amount if required.

What does an automobile insurance policy deductible mean? A deductible is the amount of cash you need to pay out of pocket prior to your vehicle insurance coverage will certainly cover the remainder - low cost auto. If you backed your cars and truck into a telephone pole, your accident insurance would certainly pay for the price of the damages.

Our Auto Insurance Deductibles - What You Need To Know - Aaa Diaries

If the total price of fixings involves $1800, your insurance coverage will only pay for $1300 (perks). You can find your insurance deductible quantities is provided on your statements web page. Having to pay an insurance deductible ways you can do a kind of cost-benefit evaluation before you make a claim with your insurance company.

We do not market your info to 3rd parties. What sort of coverage requires an insurance deductible? Not all kinds of cars and truck insurance policy coverage require a deductible. Liability insurance policy, which covers the expenses if you damage somebody's home or wound somebody with your car, never calls for a deductible. Liability protection is the backbone of the majority of vehicle insurance plans, as well as in many states in the united state, you're needed by regulation to have it.

Crash insurance coverage covers damage to your vehicle from a mishap, despite who was at fault. Both accident and also compensation coverage generally require that you pay an out-of-pocket insurance deductible but you select the quantity, and also where you set your insurance deductible will have an affect on your monthly insurance coverage premium. Just how do I decide what my deductible should be? Usually, the greater you establish your deductible, the reduced your monthly premiums.